The Buzz on Stonewell Bookkeeping

Stonewell Bookkeeping - Truths

Table of ContentsThe Ultimate Guide To Stonewell BookkeepingThe Basic Principles Of Stonewell Bookkeeping An Unbiased View of Stonewell BookkeepingStonewell Bookkeeping - TruthsExcitement About Stonewell Bookkeeping

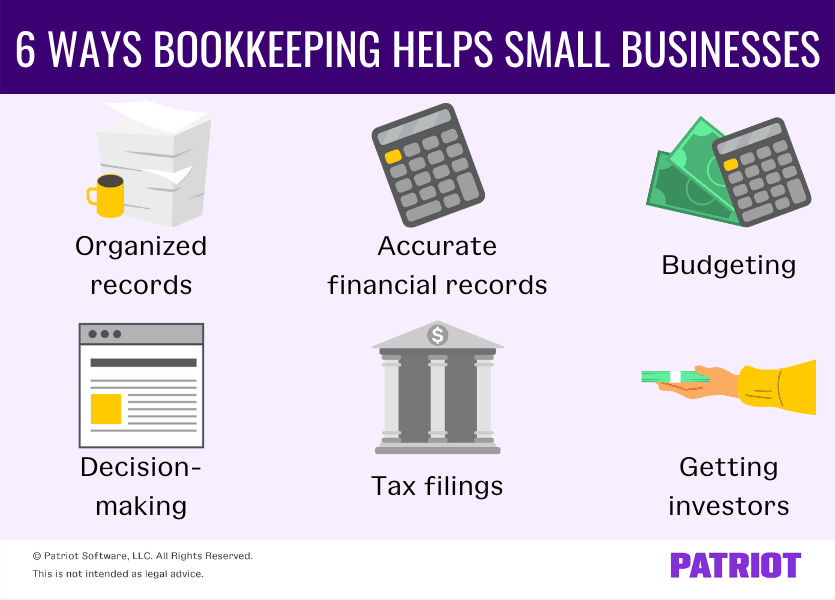

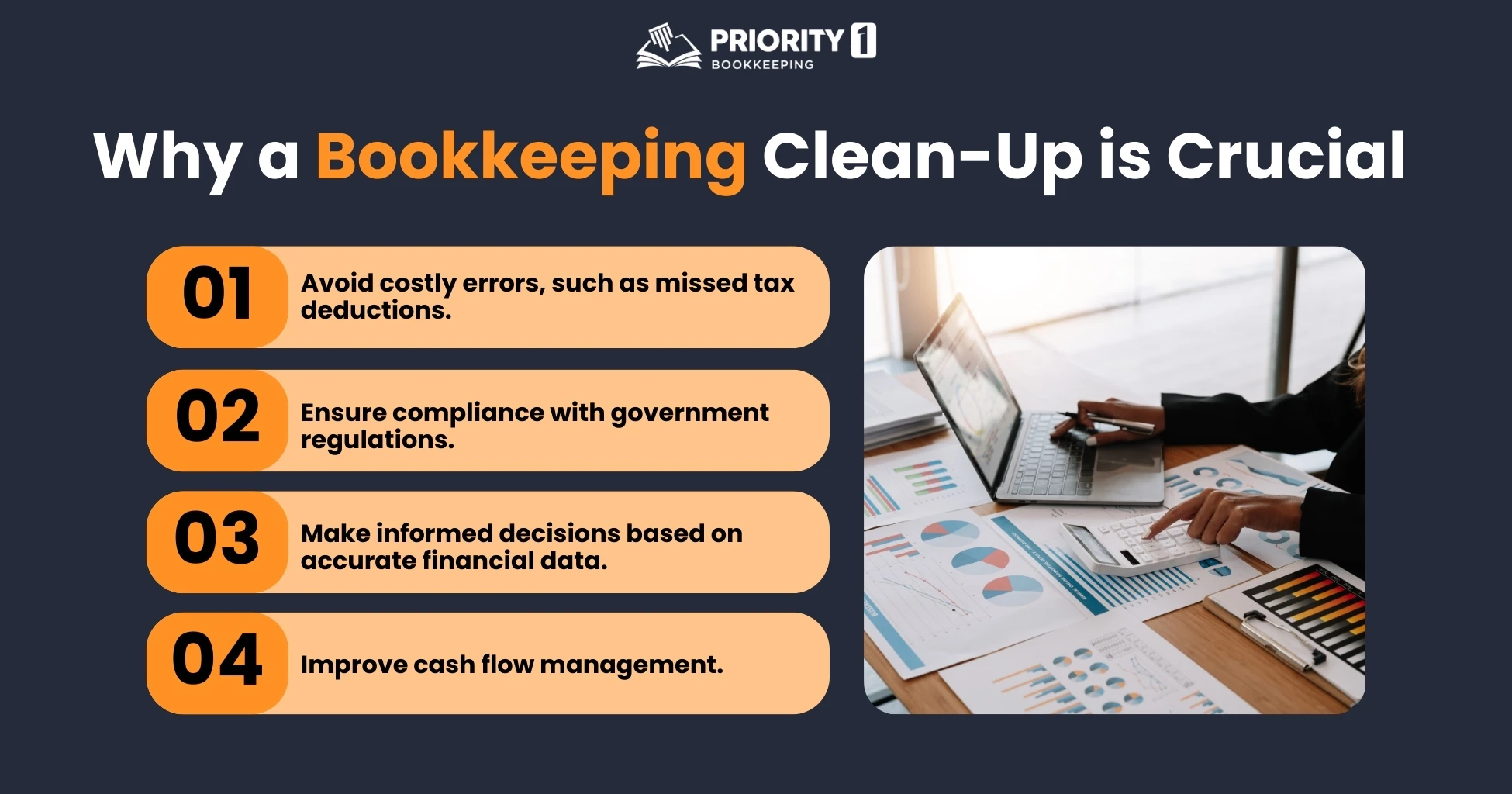

Instead of undergoing a declaring cupboard of various records, invoices, and invoices, you can present in-depth records to your accountant. In turn, you and your accountant can conserve time. As an added bonus offer, you may also be able to identify potential tax write-offs. After using your bookkeeping to file your taxes, the IRS might pick to carry out an audit.

That financing can come in the type of owner's equity, gives, company loans, and financiers. Investors require to have a good idea of your business prior to investing. If you don't have bookkeeping records, investors can not determine the success or failure of your business. They require up-to-date, exact information. And, that information requires to be conveniently obtainable.

The Basic Principles Of Stonewell Bookkeeping

This is not planned as lawful suggestions; for additional information, please click on this link..

We answered, "well, in order to know just how much you require to be paying, we need to know how much you're making. What is your net revenue? "Well, I have $179,000 in my account, so I guess my internet income (revenues much less expenses) is $18K".

Top Guidelines Of Stonewell Bookkeeping

While maybe that they have $18K in the account (and also that might not be true), your balance in the financial institution does not always establish your earnings. If someone obtained a grant or a financing, those funds are not thought about earnings. And they would certainly not infiltrate your income statement in establishing your revenues.

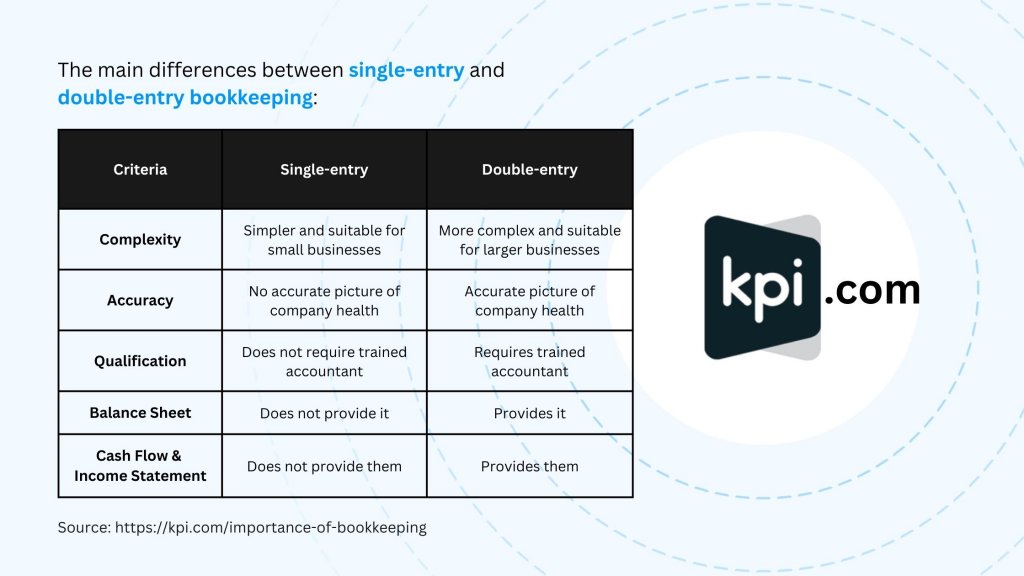

Lots of points that you believe are expenditures and deductions are in truth neither. A proper set of publications, and an outsourced accountant that can appropriately identify those purchases, will assist you recognize what your company is really making. Bookkeeping is the process of recording, categorizing, and arranging a company's monetary transactions and tax obligation filings.

A successful business calls for aid from specialists. With realistic objectives and an experienced bookkeeper, you can quickly attend to challenges and maintain those worries at bay. We dedicate our power to guaranteeing you have a solid financial foundation for growth.

Indicators on Stonewell Bookkeeping You Should Know

Precise bookkeeping is the backbone of great monetary monitoring in any kind of service. With good accounting, organizations can make better choices due to the fact that clear monetary documents use important information that can guide technique and improve profits.

Solid accounting makes it much easier to protect funding. Accurate monetary statements build count on with loan providers and financiers, boosting your possibilities of obtaining the resources you require to grow. To keep strong monetary wellness, organizations should consistently integrate their accounts. This implies coordinating purchases with bank declarations to catch errors and avoid financial inconsistencies.

They ensure on-time payment of expenses and quick consumer negotiation of billings. This improves capital and assists to prevent late penalties. A bookkeeper will certainly go across financial institution statements with interior records a minimum of once a month to locate mistakes or incongruities. Called financial institution reconciliation, this process ensures that the financial records of the business suit those of the financial institution.

Cash Circulation Statements Tracks money motion in and out of the company. These reports assist service owners recognize their monetary setting and make notified choices.

The Single Strategy To Use For Stonewell Bookkeeping

The very best choice depends on your budget and company requirements. Some local business proprietors favor to take care of bookkeeping themselves using software. While this is affordable, it can be lengthy and susceptible to errors. Devices like copyright, Xero, and FreshBooks enable company owner to automate bookkeeping jobs. These programs aid with invoicing, financial institution settlement, original site and financial reporting.